irs unveils federal income tax brackets for 2022

Michelle Fischbach R-Minn said on the House floor Democrats are calling this the Inflation Reduction Act but in reality this is just another installation of their tax. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year.

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

Your bracket depends on your taxable income.

. The IRS said the income thresholds for federal tax brackets will be higher in 2022 reflecting the faster pace of inflation. However the couples total federal tax would be 35671 about 18 of their adjusted gross income. Instead she wants the IRS to use the extra money to improve taxpayer service modernize outdated technological infrastructure and increase equity in the tax.

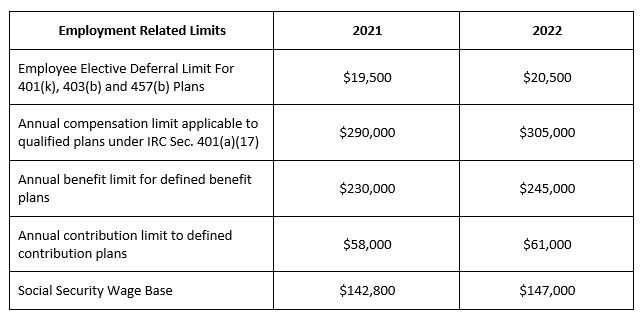

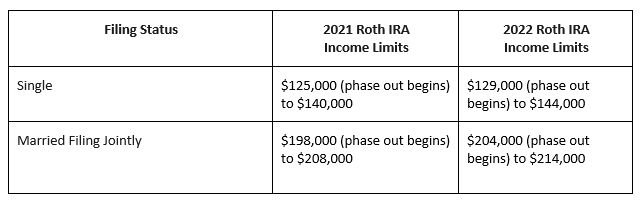

If you file jointly with your spouse and you each made 45000 in 2019 your total income subject to income tax barring deductions is 90000. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The IRS has recently announced inflation adjustments for tax year 2022 affecting over 60 tax provisions including federal income tax brackets standard deductions and tax breaks.

10 12 22 24 32 35 and 37. 9 rows As was the case and due to Trumps Tax Cuts and Jobs Acts the the personal exemption remained 0. 2 days agoAugust 10 2022 200 AM 7 min read.

Each dollar over 178150 or 21850 would fall into the 24 federal income tax bracket. 25900 Single taxpayers and married individuals filing separately. Each year the irs updates the existing tax code numbers for items that are indexed for inflation.

Married couples filing jointly. The bill known as the Inflation Reduction Act would put 80 billion toward beefing up the IRS in line with liberals long-term goals to strengthen tax collection and enforcement on. This is a.

Discover Helpful Information And Resources On Taxes From AARP. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539900 for single filers and above 647850 for married couples filing jointly. There are seven federal tax brackets for tax year 2022 the same as for 2021.

35 for incomes over 215950 431900 for married couples filing jointly. The standard deduction amount for the 2022 tax year jumps to 12950 for single taxpayers up 400 and 25900 for a married couple filing jointly up 800. The bill provides nearly 80 billion to strengthen the IRS more than half of which will go specifically to.

And the standard deduction is increasing to 25900 for married couples filing together and 12950 for. Republican lawmakers are fuming about the large boost in funding for the IRS included in the 400 billion tax health care and climate package passed by Democrats in the Senate over the weekend. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly.

The Kiddie Tax thresholds are increased to 1150 and 2300. How Federal Income Tax Brackets Work. Say a married couple filing jointly for the 2022 tax year had a taxable income of 200000.

Standard deductions and about 60 other provisions have been adjusted for inflation to avoid bracket creep. That means a married couple will need to earn almost 20000 more next. Black shark 4.

The top tax rate for individuals is 37 percent for taxable income above 539901 for tax year 2022. Ad Compare Your 2022 Tax Bracket vs. As noted above the top tax bracket remains at 37.

19400 for tax year 2022. The maximum Earned Income Tax Credit is 560 for no children. Your 2021 Tax Bracket To See Whats Been Adjusted.

There are seven federal tax brackets for the 2021 tax year. The irs changes these tax brackets from year to year to account for inflation and other changes in economy. 2 hours agoChief Critic.

The other rates are. There are seven federal income tax rates in 2022. Uses the 2021 federal income tax brackets to determine how much money youll owe the IRS or how much of a federal income tax refund you will receive.

The IRS also announced that the standard deduction for 2022 was increased to the following. 6728 for tax year 2021. The other six tax brackets set by the IRS are 10 12 22 24.

3 hours agoTreasury Secretary Janet Yellen sent a letter Wednesday to IRS Commissioner Charles Rettig calling on him not to use the funds for auditing taxpayers who earn under 400000 per year. Irs unveils federal income tax brackets for 2022 syracuse. The IRS has announced higher federal income tax brackets for 2022 amid rising inflation.

The Senate approved nearly 80 billion in IRS funding with 456 billion for enforcement raising questions about who may be targeted by future audits. The adjustments come into effect on January 1 2022 for use by taxpayers when they prepare their 2022 federal tax returns in 2023. 12950 Heads of households.

Federal Tax Brackets 2022 for Income Taxes Filed by April 15 2023. The math adds up. 15 hours agoSo the GOP staff applied 2010 audit rates to the recent tax filing data coming up with 12 billion new audits per year.

The maximum Earned Income Tax Credit for 2022 will be 6935 vs. For taxation of corporate income the tax bracket applicable to corporations is the 15 tax bracket. The refundable portion of the Child Tax Credit has increased to 1500.

IRS tax brackets are divided based on your taxable income level with different amounts taxed at different federal. This page provides detail of the Federal Tax Tables for 2022 has links to historic Federal Tax Tables which are used within the 2022 Federal Tax Calculator and has supporting links to each set of state.

Biden S Budget Proposes Tax Hike On Married Filers Over 450 000

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Irs Announces Standard Tax Deduction Increase For Tax Year 2022 To Adjust For Inflation

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Irs Announces Standard Tax Deduction Increase For Tax Year 2022 To Adjust For Inflation

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

Your Guide To Income Tax Brackets How And Why They Re Changing In 2022 Retirement Matters

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2022 Estimated Income Tax Rates And Standard Deductions

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Income Tax Deadline Fast Facts Cnn

2021 And 2020 Inflation Adjusted Tax Rates And Income Brackets

Roth Ira Traditional Ira Contribution Limits For 2021 And 2022 Tax Brackets Standard Deduction Irs

New York State Enacts Tax Increases In Budget Grant Thornton

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2022 Tax Inflation Adjustments Released By Irs

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca